Following Money 20/20 Europe, here’s a look at game-changing innovations and commercial challenges set to hit the European financial sector based on Mastercard’s experience working with financial institutions around the world

Adventures in Open Banking

Open banking is a collaborative ecosystem in which data is shared through secured APIs. It significantly improves the consumer experience by making it easier to transfer funds, compare product offerings from different banks and receive more transparency.

In Europe, open banking was triggered by market regulation, but it is also emerging in other regions looking to maintain global competitiveness and improve consumer experiences.

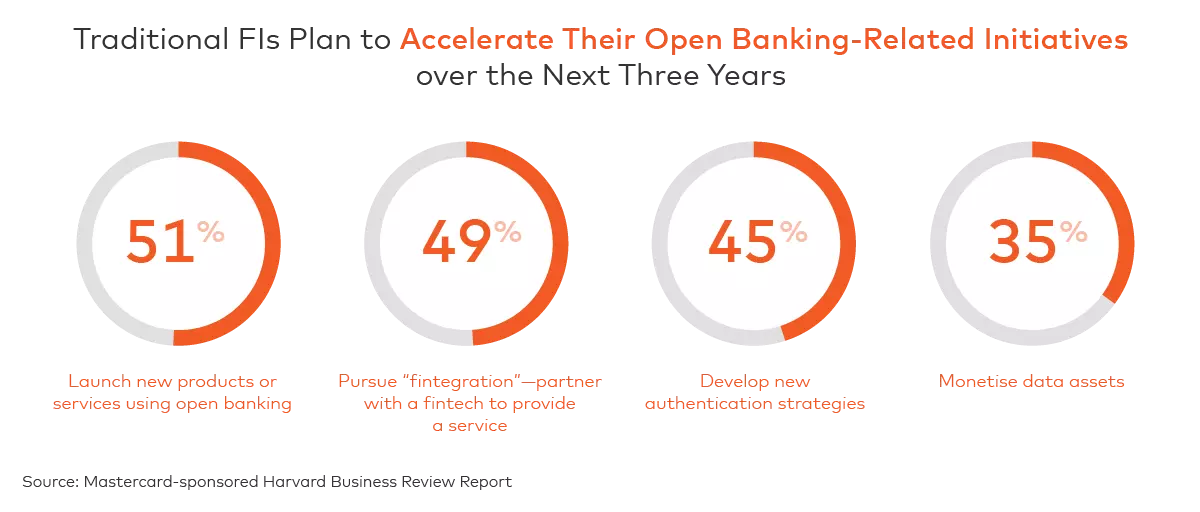

In the Game, a recent Mastercard-sponsored Harvard Business Review Analytic Services report, found that while 41% of financial institutions (FIs) believe open banking has not yet influenced their organisations, 16% are already losing customers to competitors that are better equipped to adapt to open banking. In response, traditional FIs plan to accelerate their open banking-related initiatives over the next three years accordingly:

- Launch new products or services using open banking (51%)

- Pursue “fintegration”—partner with a fintech to provide a service (49%)

- Develop new authentication strategies (45%)

- Monetise data assets (35%)

In Europe, 82% of FIs say that they’ve invested internally in the digital transformation of their existing operations, versus 68% globally, underlining a particular importance on innovating across channels.

Driving a more customer-centric ecosystem by developing APIs has clear consumer benefits but must be handled carefully by banks. FIs will need a deep understanding of the regulatory landscape before moving into strategy and product enhancements. In this regard, data insights can elucidate market changes while guiding strategy, execution, and monetisation.

Game-Changing Innovation

Traditional FIs have responded in various ways to new regulations and fintech competition. Many examples—whether through collaboration, in-house development or acquisition—were on display at Money 20/20 Europe this year.

In the Game found that while 59% of FIs believe fintechs have captured less than 10% of their market share, 65% think they will be a significant threat by 2022. In response, FIs should be using data insights and analytics to inform and refine risk management, new product launches, personalisation, and improved consumer experiences. In order to remain competitive, they must overcome organisational hurdles—such as a lack of analytical skills—and take a long-term strategic view. This may include accessing best-in-class analytics and loyalty platforms by collaborating with third-party organisations.

Data-Driven Growth

Addressing personalisation and navigating hurdles to innovation were among the themes covered at Money 20/20 Europe. Analytics help organisations make informed strategic decisions and reduce uncertainty. Perhaps surprisingly, in the Mastercard-sponsored Harvard Business Review report Uncovering the Keys to Becoming Truly Analytics-Driven, only 18% of those surveyed said that their organisations were getting a sufficient return on their investment in analytics. Challenges included:

- Ineffective deployment and distribution of outputs across the organisation

- Lack of workflow integration with decision processes not reaching decision-makers

- Inadequate employee training

- Siloed approaches producing competing results

To compete and innovate in this increasingly technology-driven market, it’s critical for financial institutions to focus on overcoming these common barriers to achieving analytic ROI. In this fast-paced, constantly evolving industry, the importance of data-driven decision-making will only continue to grow.

Looking ahead to next year’s Money 20/20, financial institutions should consider focusing on mitigating any risks from open banking while acknowledging the corresponding opportunities, taking a data-driven approach to make the most of such innovations.