Unlock detailed, product-level market insights

Mastercard Commercial Card Insights delivers quarterly reports with detailed market insights and benchmarks for virtual cards, distributed B2B cards (p-cards) and distributed T&E cards. Through behavioral modeling and segmentations, Commercial Card Insights provides issuers with actionable, product-level market information necessary to benchmark portfolio performance and identify growth opportunities.

Request a demo

Let one of our specialists show you how Mastercard Data & Services can enhance your

business performance, elevate consumer experiences and enable innovation.

Capitalize on emerging industry trends

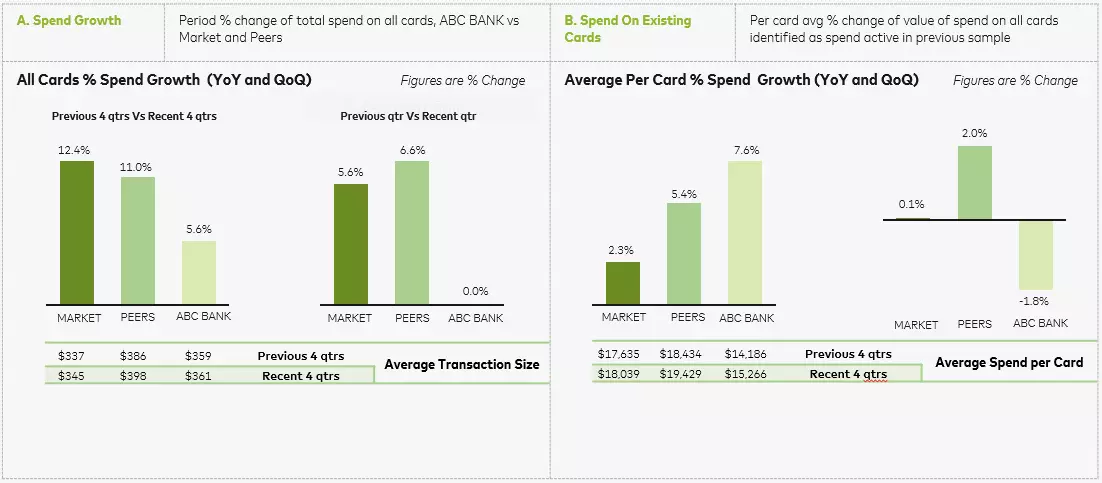

Compare portfolio performance to peer and industry benchmarks across regions, supplier categories and point-of-interaction.

Understand market size and growth trajectory by GDV growth, spend on existing cards, new account growth and attrition/inactive cards.

Identify card usage trends across category penetration, category growth, recurrent/online payments and speed-to-spend.

Discover geographic insights on regional purchasing patterns and growth of spend.

Identify segmentations for each product type

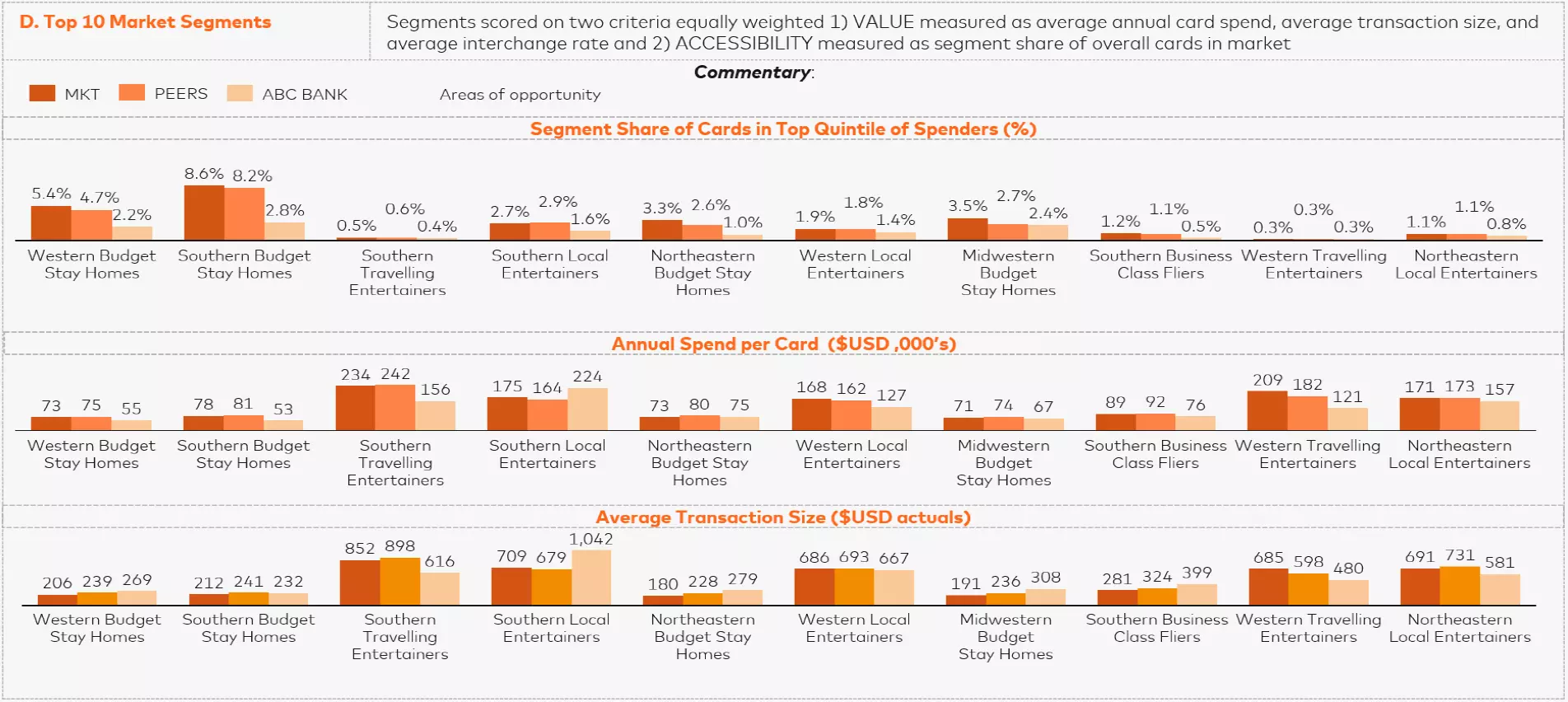

Discover the most valuable segments for virtual, B2B and T&E cards across the issuer’s portfolio, peers and the broader market.

Understand the top ten segments in the market, measured by relative share of portfolio cards and portfolio spend.

Compare segment performance to an aggregated group of industry peers and the broader commercial card market.

Measure issuer penetration of top market and peer segments.

Inform product strategy

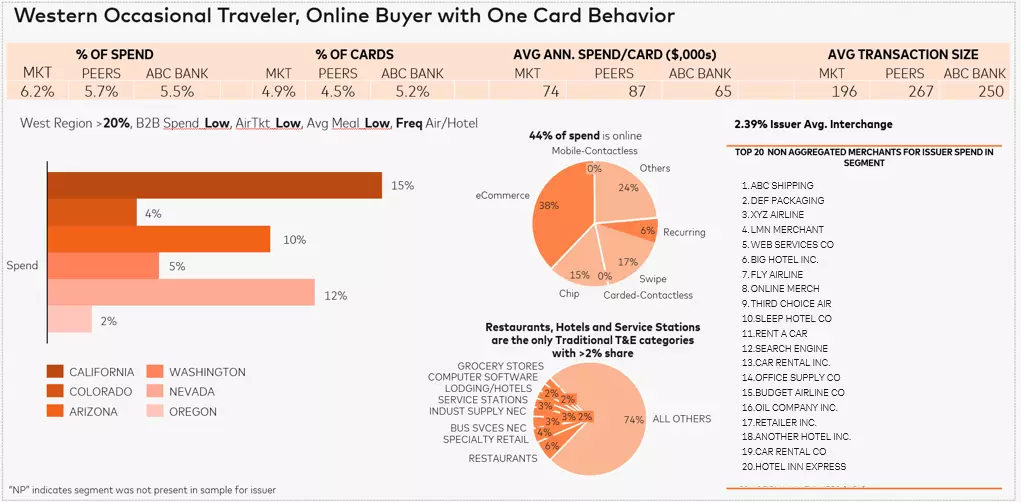

Utilize firmographic data to inform card acquisition and product strategy, identify priority customers and support supplier enablement efforts.

Identify the geographic location of portfolio spend for top segments.

Discover the top non-aggregated merchants by issuer spend in each segment.

Understand percentage of portfolio spend by point-of-interaction and supplier-type.

Mastercard Consulting

Bundle Commercial Card Insights with Mastercard consulting to grow your commercial portfolio.

A large commercial issuer wanted increased visibility into emerging trends and opportunities within its own portfolio and the broader commercial card market. Due to unreliable product code allocations, they also faced limitations in isolating trends across their three major product types (virtual, B2B and T&E cards).

Mastercard’s Commercial Card Insights provided the issuer with comprehensive information about its portfolio performance compared to a peer set and the broader commercial cards market. Using proprietary data cleansing techniques, behavioral modeling and segmentation, Commercial Card Insights delivered detailed reports by product type, enabling the issuer to identify trends and growth opportunities across their virtual, B2B and T&E card portfolios.

Example findings include:

The issuer had a lower share of virtual card spend in Hotels and Healthcare, compared with the broader market, identifying key opportunity areas.

Compared to market benchmarks, the issuer had a lower share of B2B cards in the top 10 identified market segments.

The issuer strongly over-indexed for T&E spend in Government Services, while lagging the market for share of spend in Grocery and Insurance.