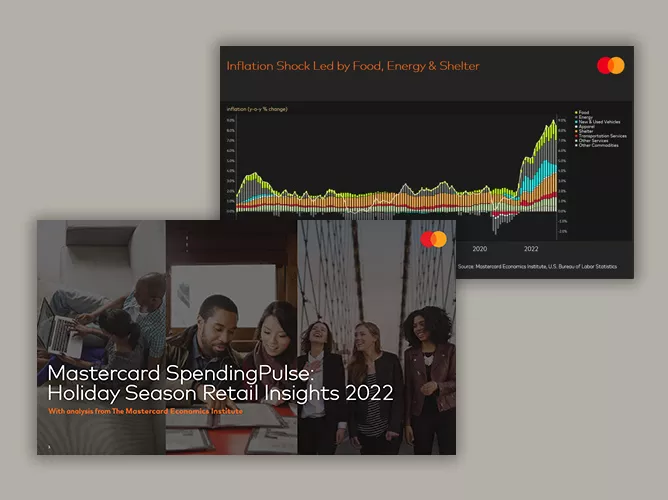

High inflation and rising interest rates set against a tight labor market: These were hallmarks of the 2022 global economy. In 2023, we’ll experience the outcome of these converging factors. Which countries and sectors are expected to grow? Which might contract, stabilize or rebound?

After years of pandemic disruption followed by a rebalancing in 2022, we look for a story of outcomes in 2023. The repercussions of high interest rates will result in multi-speeds for the global economy with a contraction in European growth, limited real economic expansion in North and South America, stabilization in the Middle East and resilience in emerging Asia.

How high interest rates are affecting housing and housing-related spending

Why trading down and shopping around are trending

How pricing and consumer preferences could be affected by slower inflation

Why omnichannel strategies are helping businesses outperform expectations

“In some countries and sectors, there has been a return to the pre-pandemic trend of discretionary retail. Others, such as travel throughout Asia, still have room for further catch-up. Some, like global housing markets, have overshot, creating excesses that will need to adjust”1

Access the interactive, global Economic Outlook 2023 report to learn how the global economy could evolve in 2023 against the backdrop of consumer and business trends and ongoing risks.

Dive into the report's insights by registering for our global webinar, and regional focused webinar on Asia Pacific insights.

1 Mastercard Economics Institute