May 30, 2023

Preface

China's economy has been growing at a rapid pace for over forty years. Credit card issuers, whether retail banks or dedicated issuing banks, have flourished during this golden age by expanding reach in a vast untapped market.

Yet as China's economy matures, overall economic growth is slowing. Fintech companies have entered the fray, customer acquisition costs continue to rise, and interest-rate spreads are narrowing under increased competition.

Regulators, aware of the effects of past focuses on quantity over quality, have meanwhile strengthened regulations around the management of existing customers and the quality of their assets. In particular, the Notice on Further Promoting the Standardized and Healthy Development of Credit Card Business requires banks to provide a comprehensive and accurate real-time response to asset risk, which restricts banks from issuing new cards if their long-term inactive credit card ratio exceeds 20%.1 The notice also imposes a series of mandatory requirements for information disclosure, consumer protection, and risk pricing and management.

As a result, customer retention is replacing quantity over quality as the new model among China’s banks. And although the introduction of personalization to complement customer acquisition is not entirely new, much remains to be explored.

Mastercard provides services across consulting, loyalty strategies, and data analytics solutions to leading banks worldwide, and has helped more than 3,000 leading companies in over 120 countries achieve quality growth through data insight-driven initiatives in accordance with Mastercard’s data responsibility principles.2 This report offers insights based on Mastercard's experiences in China, supplemented by a Mastercard-commissioned Forrester consulting survey in China of over 100 decision makers from leading financial institutions and of over 500 active cardholders.3 We hope it provides actionable recommendations to help banks continue to thrive in a “retention” economy.

We hope you enjoy the report!

Five growth opportunities for retail banking

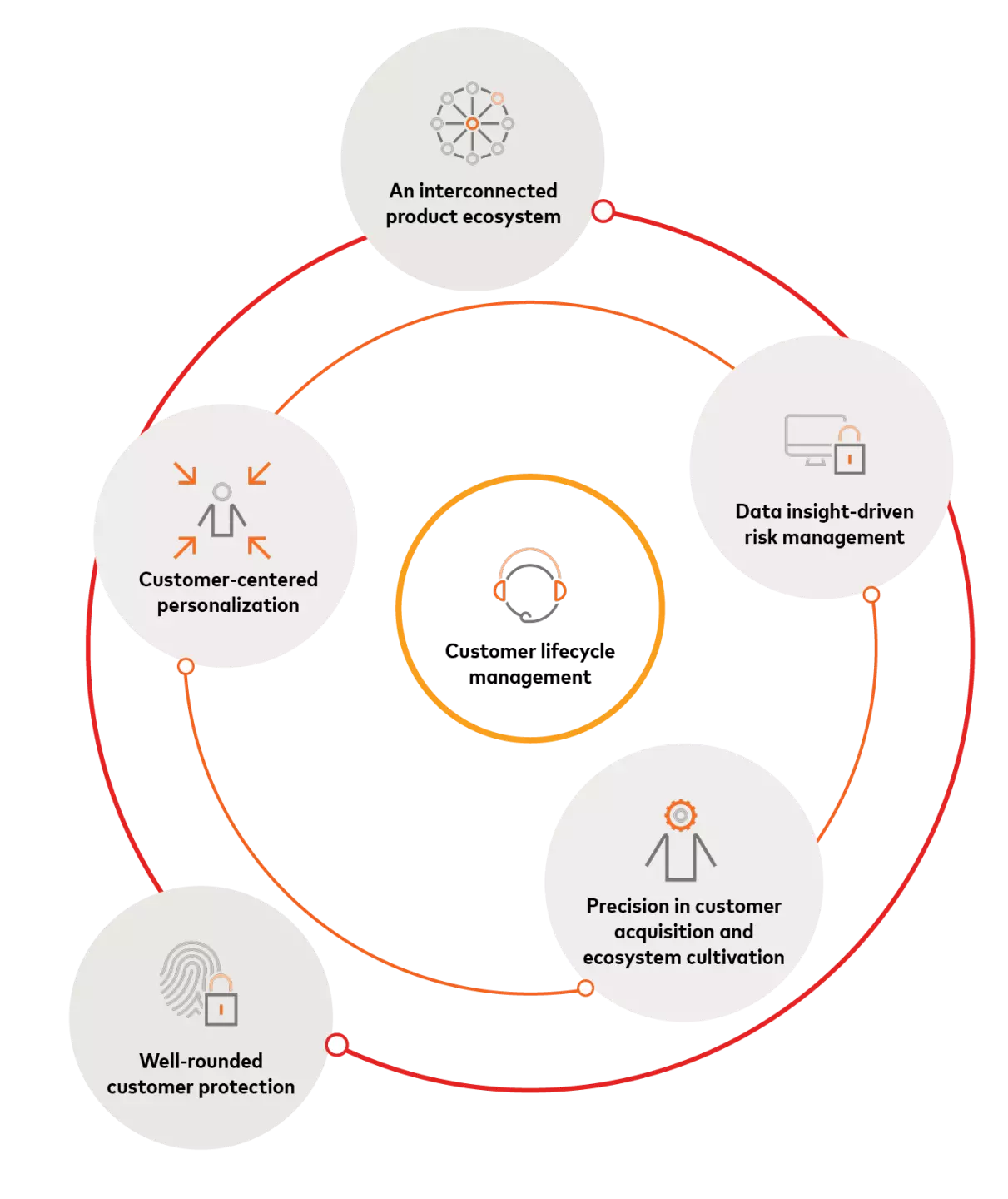

From a customer lifecycle perspective, the secrets to being a competitive issuer include more efficient customer acquisition strategies and more effective card application reviews, increased customer value and reduced risk exposure in customer management, and improved customer loyalty and retention.

These approaches should be supported by appropriate product designs and an expanded ecosystem of purchasing scenarios for customers. In addition, transparency of approach and customer protection should be embedded in the underlying architecture to ensure legal compliance every step of the way.

Mastercard has identified the following five major growth opportunities for retail banks and dedicated issuing banks based on recent shifts in the macroeconomic environment and in customer demands.

Opportunity 1: Precision in customer acquisition and ecosystem cultivation

By adopting a layered and segmented customer acquisition strategy, banks can improve customer acquisition and increase cross-selling efficiency. Banks can also build their own processes to cultivate ecosystems.

Opportunity 2: Customer-centered personalization

Banks can use their own data to improve personalized engagement with customers by city, region and purchasing scenario, and cooperate with external strategic partners for more accurate and scenario-based customer management.

Opportunity 3: Data insight-driven risk management

Banks can add profitability considerations to their risk management strategies by pursuing a model where overall revenue effectively covers risks and other costs while effective economies of scale reduce per-unit fixed costs.

Opportunity 4: An interconnected product ecosystem

In addition to expanding cooperation with retail partners and increasing presence in key purchasing scenarios, banks can strengthen links between various financial products and reduce retention costs by adopting a “total relationship banking” strategy.

Opportunity 5: Well-rounded customer protection

Banks should make customer protection and customer experience their core competencies by considering customer privacy at every touchpoint to avoid overly intrusive engagement and ensure appropriate and compliant use of data.

Figure 1: Five trends covering all customer lifecycle needs and the underlying architecture.

Figure 1: Five trends covering all customer lifecycle needs and the underlying architecture.

Opportunity 1: Precision in customer acquisition and ecosystem cultivation

A slowdown in dramatic increases in credit card issuance in China is giving way to more strategic competition in a fiercely competitive market as customer acquisition costs continue to climb.4 The rise may continue in upcoming years as companies focus their resources on online channels as a result of the Covid-19 pandemic.

Growth in customer value is not keeping up with increasing customer acquisition costs because of the overall economic slowdown and rising customer risk levels caused by the pandemic. These factors have led banks to move away from endless bidding for online advertising and instead look for ways to improve cross-selling efficiency by building on their existing customer bases.

Facing the current challenges, banks should focus on two growth opportunities. The first is more precise cross-selling, which is done by creating tailored marketing content specific to customer segments in order to improve response rates and, by extension, card applications. The second is to cultivate ecosystems to keep traffic circulating in their own ecosystems and then cross-sell whenever customer behavior indicates an opportune moment.

A. Precision cross-selling to acquire customers

The low cost of SMS and WeChat messages led many banks to adopt blanket marketing strategies by indiscriminately bombarding whitelisted customers with similar messages. But each failed marketing effort can cause customer churn and often results in more financial loss than just the cost of the campaigns. Mastercard's experience shows that after three to four consecutive ineffective campaigns, a customer will likely no longer pay attention.

Many banks are developing more precise customer acquisition strategies that incorporate detailed customer segments and provide tailored marketing across channels. Some are also developing supporting infrastructure, such as segmentation systems containing information on pre-approved credit limits, optimal cards and appropriate customer service phrases. When a customer enters a bank, the staff can then immediately offer personalized cross-selling by identifying the appropriate segment.

Mastercard optimized a leading bank’s cross-selling whitelist model while fostering interaction between headquarters and branches. Customer conversion rates at pilot branches increased by nearly 30%.

A leading bank had a large debit card customer base but had failed to build a precise credit card cross-selling strategy. Despite constant marketing messaging on a large scale, response rates were low.

A Mastercard review of the bank's strengths and weaknesses found that the bank had not established a segmentation system based on customer lifecycle value. Its existing marketing whitelist model failed to maximize profits and solely considered risk without balancing it with revenue considerations.

Mastercard helped the bank build a customer-permissioned segmentation system that incorporates customer preferences and risk factors to optimize the bank's cross-selling model and enable monthly updates to the marketing whitelist based on customer behavior. Dedicated channels optimize cost effectiveness and use different value propositions across customers.

Mastercard also used the bank's extensive network of branches to increase overall reach by strategically adding touchpoints. In addition, several customer-response playbooks, based on different scenarios and customer segments, helped branches personalize their marketing efforts.

The new model consistently yielded significantly higher return on investment from whitelisted campaigns. The customer conversion rate of pilot branches increased by nearly 30%, and customers acquired by cross-selling rose by more than one million.

B. Cultivate ecosystems through WeCom

As the customer conversion rate of general online traffic became increasingly expensive and less desirable over the years, many banks developed their own mobile apps. This approach was short-lived for various reasons—most notable were weak links between the apps and everyday purchases.

Since 2019, retail banks have instead tended to focus efforts on WeCom, a business communication tool similar to WeChat, that is widely used in the retail and consumer goods sectors for communication between businesses and customers.

There are two main approaches. They are not mutually exclusive, but it can be challenging to find the right balance.

A common approach is to use WeCom as an additional channel for engaging with early-stage customers recently acquired by banks through other channels. WeCom focuses on everyday purchasing and engenders customer loyalty and spending by engaging customers with relevant information and promotions. Its analyses of customer behavior to identify preferences and profiles can provide insights into potential financial needs.

A bank’s mobile app can then access this separate pool of WeCom users to offer personalized messages to those who express interest in financial products and services. The approach can be an efficient way to redirect early-stage customers back to a bank’s ecosystem, but it requires considerable and consistent investment in WeCom.

An alternative approach positions WeCom as the entry point for entire customer journeys. This strategy uses WeCom as a direct customer acquisition channel through various lifestyle offerings, such as e-commerce offers to users who are not necessarily customers of the bank.

This progressive relationship between WeCom and a bank requires less investment than when using WeCom as a separate pool of traffic, but it asks a lot of a bank’s ecosystem. If the ecosystem is not attractive enough, WeCom users might not migrate over to the bank’s ecosystem or might not stay for long once they arrive. There may even be a loss of opportunities for future engagement through WeCom because of poor customer experiences.

Mastercard helped a leading bank build an end-to-end WeCom strategy that increased the average number of credit card transactions by nearly 80%.

A bank noticed the potential value of WeCom early in the Covid-19 pandemic but encountered bottlenecks in strategic positioning and implementation.

Mastercard provided the bank with end-to-end support through consulting services and insights into the banking and payments industry.

First, Mastercard helped the bank better position its own channels to build a competitive WeCom strategy. Based on the bank’s distinctive existing approaches to customer acquisition and engagement, Mastercard helped the bank review the WeCom customer journey to identify specific customer-permissioned strategies for specific stages.

For example, the bank might offer discounts at regionally relevant retailers to foster card use by newly acquired customers, or it might engage with high-value customers in a highly personalized manner via WeCom to prevent drop off.

The success of the strategy saw a doubling in the number of followers on WeCom in the initial phase, double-digit growth in community activity and transaction volume, and a nearly 80% increase in the average number of transactions. Encouraged by the success, the bank plans to make WeCom a key part of its strategy moving forward.

Opportunity 2: Customer-centered personalization

Banks face a challenge when 68% of Chinese retail banking customers believe that all banks are essentially the same. A lack of personalization makes customers liable to leave for better offers elsewhere. Banks that offer personalization can stand out when 47% of customers favor credit cards that offer more personalized promotions.

Customer-centered personalization uses data insights in two ways. One option is to rely exclusively on a bank’s own data to personalize offers and segment customers; another option is to collaborate with third parties while complying with legal and regulatory requirements.

A. Customer-centered personalization using a bank's own data

Banks have long used their own data to build customer profiles for personalization: 42% have used traditional touch points such as SMS, 51% have used mobile apps and other mini apps, and 62% plan to diversify channels and customer purchasing scenarios for such purposes over the coming years. Yet results have been lackluster, and 57% consider it a challenge to measure the benefits and costs of personalization.

42% of banks have used traditional touch points such as SMS

The vastness of China means economic development, cultures, habits and demographics vary from city to city. Mastercard's experience shows that successful personalization often depends on the ability to tailor strategies to different cities, customer segments, competitive landscapes, and purchasing scenarios. Many banks still adopt one-size-fits-all strategies that fail to appreciate local nuances and lead to mismatches. Smaller cities tend to share some commonalities in offering ample opportunities for expansion, while bigger cities are home to fiercely competitive marketplaces.

51% of banks have used mobile apps and other mini apps

A single blanket approach to personalization will result in limited customer engagement from the outset. Success comes from scenario-based marketing that ensures banks can deftly meet customer needs regardless of activity type. A common solution is a rules-based push-marketing engine that automatically sends relevant offers in real time once a customer's behavior meets certain criteria.

62% of banks plan to diversify channels and customer purchasing scenarios over the coming years

The operative words are "timely" and "appropriate" in reference to meeting a customer's needs in real time whatever the circumstances. Whether building scenario-based marketing capabilities in-house or seeking help from external partners, integrated systems and timely services are key.

Mastercard helped a leading joint-stock bank build an end-to-end strategy for personalized customer management.

A Mastercard analysis found that a bank was mainly focusing on generic customer-level considerations—such as age, income, and value contribution in its personalized marketing—without considering city-specific and region-specific characteristics. As a result, similar campaigns produced vastly different outcomes in different regions.

Mastercard first analyzed select cities of various sizes in terms of economic, cultural, infrastructural and demographic characteristics. It then conducted more precise and local segmentations based on customer characteristics and consumption habits in each city.

The analysis showed consumption habits in bigger cities to be diverse and spread across distinct customer groups. For example, bigger cities feature many working-class newcomers who have migrated from other cities and focus their spending on everyday needs such as food, clothing, housing and transportation.

Mastercard also analyzed the competitive landscape for retailers, such as restaurants and convenience stores, in cities of various sizes. Competition for young credit cards customers is fierce in big cities, but there are abundant growth opportunities in smaller cities for credit card products with everyday spending benefits.

B. Customer-centered personalization in collaboration with third-party partners

Banks often only have access to their customers’ financial data and some demographic data. External organizations with a better understanding of customer behavior can often help. For example, 74% of banks plan to pilot personalized customer management on emerging third-party social media platforms.

Federated learning, a form of collaborative machine learning that does not require data exchange, and other secure multi-party computation technologies are useful solutions for banks to collaborate with third parties while remaining in compliance with regulations. A potent combination comes from pairing such approaches with scenario-based marketing.

Mastercard helped a leading bank deploy federated learning via a third-party digital platform, which nearly quintupled the success rate of reactivating dormant cardholders.

A leading bank found that its typical campaigns were not cost-effective since very few inactive cardholders were engaging with them.

Mastercard helped the bank deploy federated learning and other secure multi-party computation technologies via a leading digital platform to identify the characteristics of customers more likely to re-engage.

The bank’s precision marketing complied with legal and regulatory requirements, and its success rate with inactive customers nearly quintupled. About 80% of the reactivated customers continued to spend even after the campaign ended.

Opportunity 3: Data insight-driven risk management

Domestic fintech growth, economic slowdown, and Covid-19 have highlighted the importance of precision risk management.

Banks’ existing risk management strategies tend to suffer from imprecision. Whitelists provided by risk management departments can constrain outreach. Instead of a one-size-fits-all approach, a balance between risk and return can make revolving interest and installment plans into important sources of revenue.

An important holistic consideration is whether the revenue generated by customers is sufficient to cover any associated risks. Certain customer segments merit differentiated credit treatment as long as any approaches are compliant and in accordance with portfolio composition. This precision risk management may cover micro and macro perspectives.

A. A micro perspective

Many banks have started to optimize pricing based on customer segmentation, but they often encounter challenges around infrastructure.

For example, tests of risk-based pricing for different customer segments usually require collaboration across departments. But the process is too rigid to accommodate rapid data insight collection and analysis, so it can be challenging to adjust quickly when customer behavior or markets change.

78% of banks consider it important to use digital means to enable smart risk management

It is not efficient when banks are unable to maximize profits during stable periods while having to tighten up risk strategies during more volatile periods.

As banks develop their risk-based pricing capabilities at the micro level, their models should be based on customer segment behavior and not merely on general profile data, such as gender and age.

65% of banks complain that the results of AI models are difficult to understand

When 78% of banks consider it important to use digital means to enable smart risk management, the interpretability of algorithms is essential for any AI solutions. That is particularly so when 65% of banks complain that the results of AI models are difficult to understand, and the same number say that the results of AI models cannot be replicated in practice.

Mastercard helped a leading bank build precision risk-based pricing capabilities, boosting predicted profits from installment payments by nearly 30%.

A leading bank was using a one-size-fits-all risk-based pricing model that lacked the ability to fine-tune pricing for different customer segments.

Mastercard helped the bank build precision risk-based pricing capabilities to generate customer level pricing and maximize revenue while ensuring acceptable overall risk levels and pricing discounts.

Mastercard also set up a project management office to help the bank establish cross-departmental collaboration to embed the risk management philosophy throughout the business. Multiple rounds of experiments systematically reviewed customer segment characteristics and performed more precise segmentation through iterative testing while simultaneously checking for model bias.

For example, the bank was overly reliant on the insight that customers who recently used installments are more likely to use them again, so it tended to direct its campaigns only at those customers. Yet tests showed general price sensitivity to be a more useful metric.

The bank’s pilot indicates that their new strategy should increase profitability from installments by nearly 30%.

B. A macro perspective based on profit and loss (P&L) forecasts

In addition to ensuring that customer revenue is sufficient to cover risks at the micro level, banks can also calculate the potential P&L of their customer base at the macro level by building simulations and projections to proactively adjust portfolio risk.

Leading banks tend to create multiple scenarios based on potential developments and then adapt their business strategies accordingly. For example, if real-time data insights reveal elevated risk in a particular customer segment, banks can dynamically reduce product advertising accordingly. Conversely, if a significant increase in potential profit is observed for a particular segment as a result of macro changes, banks can increase activity. Such adjustments are frequent and may even happen on a weekly basis.

A key to macro-level precision risk management is a bank's ability to calculate potential P&L at the customer segment level and to quickly update models based on the latest data insights. That means removing data silos and building models that can be easily maintained and quickly updated. Heavy reliance on manual modeling to provide updates on a quarterly or annual basis makes it difficult to keep up with rapidly changing environments.

Mastercard helped a leading bank build macro-level risk management capabilities, increasing predicted return on assets by nearly two percentage points.

A leading bank had reduced its customer acquisition efforts in the early stages of the Covid-19 pandemic to avoid over exposure, but it later wanted to restart its acquisition efforts.

Mastercard started with a risk assessment based on a calculation of overall customer P&L. The bank did not have the capability to perform dynamic P&L calculations for different customer segments, so Mastercard deployed analytical tools internally to create an easy-to-maintain background system to handle timely data updates.

Mastercard then built predictive models spanning several years of potential business scenarios along with a dynamic P&L calculation platform based on banking data insights that included asset types. The platform integrates risk into its P&L calculations based on purchasing scenarios and customer segments to empower macro-level risk management.

Predictions suggest the platform will increase return on assets by nearly two percentage points.

Opportunity 4: An interconnected product ecosystem

Narrow margins resulting from intense competition have hampered the ability of Chinese issuers to offer differentiated scenario-specific card benefits. Chinese issuers try to circumvent this predicament in two main ways.

The first is to use credit cards as a tool for customer acquisition by introducing customers to the bank’s ecosystem and then profiting from other financial services there. The second is to create environments that promote customer spend.

A. Using credit cards to build an ecosystem of retail financial services

Banks increasingly expect credit cards to serve as a steppingstone to customer acquisition by enabling cross-selling of other products through further marketing. Although 87% of banks consider financial product recommendations as the most important component of personalization, 75% of cardholders are most interested in promotions and offers. Meanwhile financial product recommendations rank only third in importance for customers and reveal a mismatch in priorities between banks and users.

87% of banks consider financial product recommendations as the most important component of personalization

Some banks are trying to address the mismatch through “total relationship banking.” It combines a retail bank’s business lines by integrating all customer needs into one ecosystem, such as credit cards, savings and remittances, wealth management, credit loans, and home loans. As customers engage more in one area, they can enjoy additional benefits in other areas.

Total relationship banking creates a win-win situation. Offering discounts to customers may result in a slight decrease in profitability for each business line, but overall profits increase across the bank’s ecosystem when the bank becomes a one-stop shop for customers’ financial needs. As a result, banks can offer more rewards and benefits to total relationship banking customers to further boost customer loyalty, and customers can benefit from more favorable prices.

75% of cardholders are most interested in promotions and offers

But the implementation of total relationship banking can be challenging. Facilitating collaboration across departments and even business units can be extremely high, and key performance indicators need an overhaul to reflect new operating models. In addition, interconnections between products should be clear and simple, but banks often set too many conditions for fear of not recovering costs. Customers then end up struggling to connect the dots. For example, credit cards are the most frequently used financial service and play a key role in total relationship banking, but reasonable cost sharing with other business lines remains nascent.

To sustain the strategy when cost seems to outweigh profit, banks can bring in an external team with hands-on expertise in total relationship banking to set up communication between departments and to provide a solid framework with predicted financial outlays for each phase of the strategy.

Mastercard helped a leading bank in Greater China to build a total relationship banking strategy across credit cards, insurance and wealth management.

A leading bank in Greater China had a mainly mature customer base. It wanted to improve the appeal of its products through a total relationship banking strategy to attract new customers while enhancing the loyalty of existing customers.

Mastercard helped the bank issue a credit card as part of a total relationship banking strategy. The credit card benefits extend to insurance and wealth management, and cardholders can upgrade benefits by meeting certain contribution criteria such as making deposits over specific amounts or using the card to pay for investment funds or insurance products.

Premium credit card benefits include a preferential cashback rate alongside an additional percentage of bonus reward points that can be deducted from any purchase of investment funds or insurance, which further boost customer willingness to try other products.

To ensure that the cards are attractive to prospective customers, Mastercard analyzed segments of customers who had purchased various products at the bank. A segmentation of those customers enabled the bank to determine the most popular purchasing scenarios for the highest value segments who would appreciate additional benefits.

To increase efficiency around customer acquisition, Mastercard took inspiration from an analysis of the bank’s existing high net worth customer segments. A fast-track process allows an instant upgrade to a premium card if a cardholder’s family member also has such a card. By taking this approach, the bank successfully onboarded other family members of many of these customers and quickly expanded the bank’s customer base into a high-value, different demographic.

Mastercard also designed a cost-sharing approach to promote collaboration across departments that spans insurance, investment funds and credit cards. The credit card quickly became a hit.

B. End-to-end development of personalized purchasing scenarios to boost customer spending

If 47% of cardholders opt to use credit cards that offer more personalized benefits in certain purchasing scenarios, major banks naturally want to provide retailer ecosystems that can meet customer needs as they arise.

47% of cardholders opt to use credit cards that offer more personalized benefits in certain purchasing scenarios

However, creating ideal purchasing scenarios is more than just partnering with a wide network of retailers or constantly sending customers promotional notifications from popular retailers. Rather, it is about identifying "pivotal" scenarios based on customer segment demographics and then developing them end-to-end. The focus can then shift to promoting solutions to "needs" and not just cross-selling products to customers.

There are two layers to pivotal purchasing scenarios. The first can drive consumption habits and further increase customer activity. The second connects with other purchasing scenarios and creates spillover benefits. The credit cards of banks that successfully identify pivotal purchasing scenarios are very likely to become “top of wallet” – particularly in China where differentiation between credit cards is lacking.

Purchasing scenarios may change among different segments and locations, and banks need to adjust accordingly to properly identify a segment’s pivotal scenarios and invest strategically. After identifying scenarios, banks can then review whether the current retailers in their ecosystem are appropriately meeting customer needs and add others as necessary.

Timing is critical. Many retailers have a very short lifecycle in an era of social media where instant success through a celebrity endorsement can almost as rapidly turn into mediocrity. A bank that passively manages purchasing scenarios may offer premium subsidies to have a retailer join its ecosystem only for the retailer’s popularity to quickly decline while the cost to the bank remains the same.

A bank’s own ecosystem, such as a mobile application, is itself a source of internet traffic. As a representation of the volume of netizens visiting an internet platform or application, it provides market opportunities.

If a bank proactively initiates strategic cooperation with retailers in creating purchasing scenarios, it can find the most opportune time to bring retailers into the ecosystem on favorable terms. For example, the scheduled grand opening of a retailer in a major city may provide a bank with the opportunity to use its own internet traffic to partner with the agency behind the retailer’s celebrity endorsement. Together they can create purchasing scenarios that take advantage of their respective strengths.

Mastercard helped a leading bank take stock of its purchasing scenarios and establish an actionable framework, which increased the volume of retail transactions by 20%.

A leading bank was looking to build a more customer-centric strategy and increase its share of active customers. Mastercard worked with the bank to develop a three-step end-to-end approach: analyze and determine customer segments and corresponding spending patterns; pinpoint purchasing scenarios relevant to each customer segment; establish purchasing scenarios with the potential to increase customer loyalty.

Mastercard used a "natural experiment" approach to eliminate systematic variance, a random-effects model to minimize bias, and then a correlation analysis and a fixed-effects model to analyze customers’ spending habits. Based on the results, customers segments were determined to assess key purchasing scenarios that correlate with other everyday purchasing scenarios across cities and segments.

Mastercard advised the bank to concentrate its resources on a select few key scenarios and launch a series of marketing campaigns to boost spending in a timely manner across the correlated scenarios.

Mastercard helped the bank partner with over 10,000 retailers that met the definition of providing “pivotal” purchasing scenarios. Total transaction volume increased by nearly 20% and significantly improved several performance indicators.

Opportunity 5: Well-rounded customer protection

New customer protection regulations support the healthy development of the credit card industry, better protect consumer rights and interests, and provide banks with clear guidance on how to improve services.

Banks can improve precision in customer management and data analysis in a compliant manner by capturing new opportunities in industry transformation and recognizing the full potential of customers.

A priority for 61% of banks is to balance data analysis with the protection of customers’ personal information, and 49% of decision makers plan to roll out data governance programs to ensure compliant data access and transparency of use.

61% of banks prioritize balancing data analysis with the protection of customers’ personal information

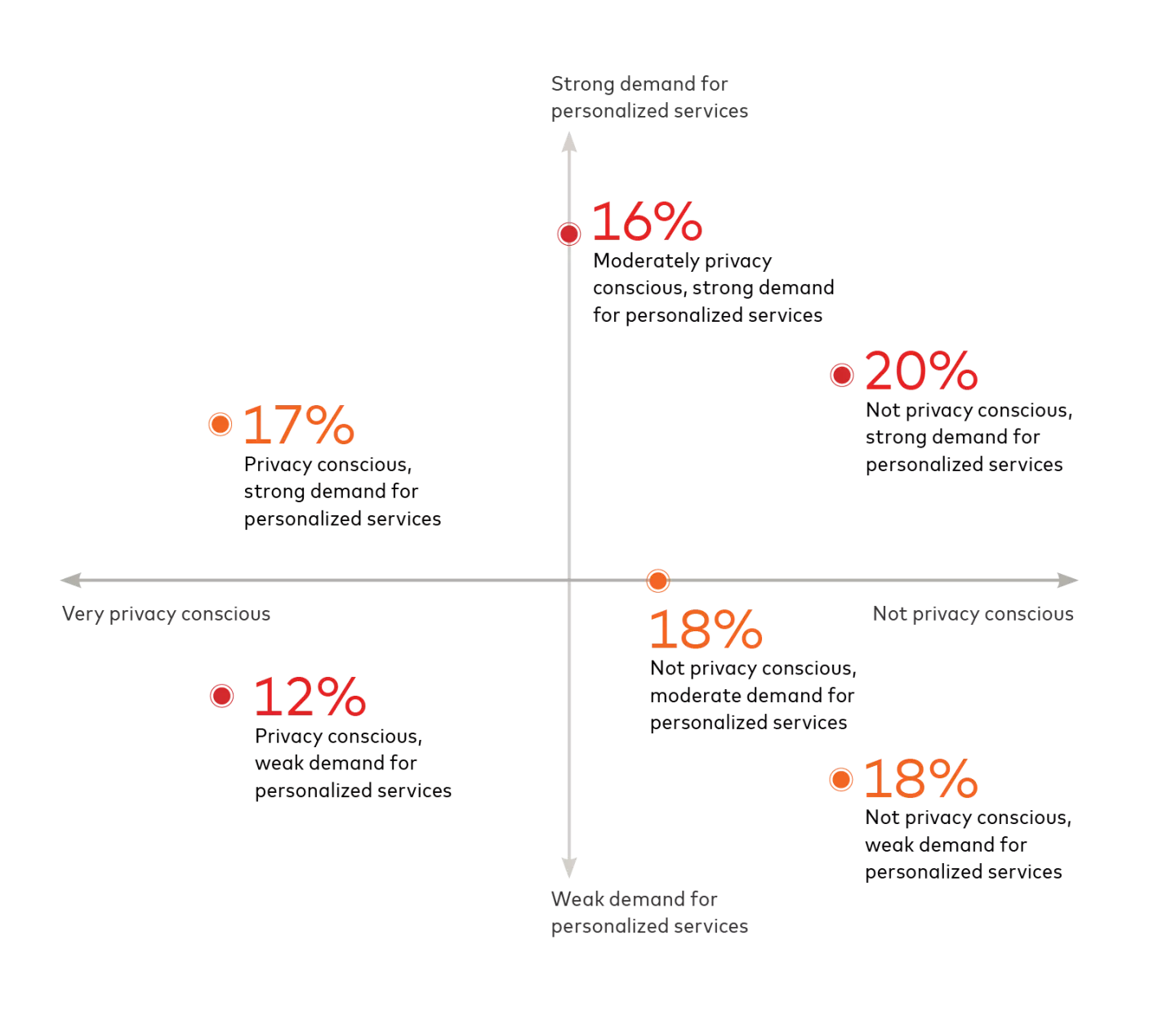

Banks will need to determine the appropriate steps to balance consumer expectations of privacy and desire for personalized services, in order to better serve consumers in a privacy-preserving way. The chart below illustrates a cluster analysis of the results of a survey of 524 cardholders.

Figure 2: Level of privacy consciousness and need for personalized services of different customer groups (Survey sample: 524 credit card users in China. Source: Forrester survey commissioned by Mastercard in March 2022).

Figure 2: Level of privacy consciousness and need for personalized services of different customer groups (Survey sample: 524 credit card users in China. Source: Forrester survey commissioned by Mastercard in March 2022).- Privacy-conscious cardholders take proactive steps to prevent banks from collecting their activity data, do not allow any use of the information retained by banks beyond the necessary processes, and do not share any data with banks unless asked to do so.

- Moderately privacy-conscious cardholders are willing to share some information with banks for something in return.

- Cardholders that are not privacy conscious do not take steps to prevent banks from collecting their activity data and allow use of their personal information in exchange for benefits.

Three groups of customers warrant particular attention:

16% of customers are willing to share some of their personal information for something in return. This group of customers has the strongest demand for personalized services and the highest level of monthly household income among all groups.

12% of customers are most concerned about privacy and have limited demand for personalized services.5

20% of customers are not privacy conscious and show strong demand for personalized services. They earn and spend less, and are likely to be most interested in low prices.

Banks should consider whether processes to handle customer complaints should be enhanced. In addition to having an adequately staffed team, a process should exist to transfer high-risk customer complaints to dedicated specialists to achieve timely resolution.

49% of decision makers plan to roll out data governance programs to ensure compliant data access and transparency of use

Data analysis is an oft-neglected step that can be used to identify causes of customer complaints so that they may be addressed at the source, which significantly cuts additional costs. Banks should integrate their customer complaint management systems to facilitate standardized management and back-end data analysis.

Mastercard helped a leading bank analyze customer complaints and improve its complaint handling process to reduce complaints by almost half.

A leading bank found that the churn rate of customers who had filed complaints was more than twice that of other customers and wanted to identify the causes.

Mastercard began by comparing the bank's processes with those of competitors. The main problem was the lack of a dedicated team to handle complaints. As a result, the handling of complaints required a lot of collaboration among various departments, which resulted in inefficiency and an escalation in the number of complaints. Another problem was that the complaint management system was not well-integrated. Records of complaints could go missing, and inconsistent formats made data analysis difficult.

A further Mastercard analysis revealed that disputes over interest fees were one of the biggest issues. Customer loyalty could suffer because of disputes over fees. Keywords such as "unclear," "not clearly written," and "vague," suggested that most customers felt there was an information gap between themselves and the bank, and that the bank should provide more transparency at every touchpoint.

Mastercard helped the bank overhaul its process by establishing a dedicated team for high-risk complaints, standardizing the system and format of records, and proposing measures to address the source of complaints. In pilot regions, the total number of complaints dropped by nearly half.

Outlook

The market is changing drastically. Covid-19 increased customers' reliance on online channels and increased the cost of customer acquisition. Rising awareness of the protection of customers and their personal information disrupts previous business practices. In response, China's major retail banks and dedicated credit card companies are adopting more precise strategies.

This report identifies five growth opportunities based on an analysis of the shifting economic environment and customer demands. It is supported by Mastercard’s experience in China and corroborated by benchmarks set by leading global banks. Each growth opportunity details one or two specific strategies, supported by case studies, to provide banks with actionable recommendations.

Opportunity 1: Precision in customer acquisition and ecosystem cultivation

By adopting a layered and segmented customer acquisition strategy, banks can improve customer acquisition and increase cross-selling efficiency. Banks can also build their own processes to cultivate ecosystems.

Opportunity 2: Customer-centered personalization

Banks can use their own data to improve personalized engagement with customers by city, region and purchasing scenario, and cooperate with external strategic partners for more accurate and scenario-based customer management.

Opportunity 3: Data insight-driven risk management

Banks can add profitability considerations to their risk management strategies by pursuing a model where overall revenue effectively covers risks and other costs while effective economies of scale reduce per-unit fixed costs.

Opportunity 4: An interconnected product ecosystem

In addition to expanding cooperation with retail partners and increasing presence in key purchasing scenarios, banks can strengthen links between various financial products and reduce retention costs by adopting a “total relationship banking” strategy.

Opportunity 5: Well-rounded customer protection

Banks should make customer protection and customer experience their core competencies by considering customer privacy at every touchpoint to avoid overly intrusive engagement and ensure appropriate and compliant use of data.

2 All the data was handled following Mastercard Data Responsibility Principles.

3 Online survey in China in March 2022 of 102 business leaders in payment cards and 524 active credit card users, as well as in-depth interviews with six key decision makers in the card business from China's state-owned and joint-stock banks. All stats throughout this report are taken from this survey unless otherwise noted.

4 信用卡市场发展洞察:商业银行竞逐大零售,浦大喜奔APP探索大零售融合经营体系. Analysys (易观分析), 19 September 2022.

5 They will take proactive steps to prevent banks from collecting their activity data, do not allow any use of the information retained by banks beyond the necessary processes, and do not share any data with banks unless asked to do so.