July 31, 2023

Introduction

As banking products become increasingly similar and commoditized, customer experience and value-add products and services are key differentiators.

Today’s digital-savvy consumer compares any financial product to their favorite mobile app, a front-end for the card itself, and demands the mobile phone be the center of any daily interaction. Financial institutions are under pressure to respond to these growing consumer expectations around immediacy, simplicity, safety and transparency through digital payments.

Financial institutions, however, face growing market and regulatory pressure, including increased competition, often from non-traditional competitors, heightened legislation on fees and capital requirements, and margin and revenue compression.

Additionally, customer experience expectations continue to evolve. For example, 84% of adults globally, “expect to be able to make purchases when they want and how they want.”1 Businesses that provide multiple ways to shop and pay are best positioned to meet these expectations.

Real-time payments (RTP) are another omnichannel payment option to address the expectations of speed and convenience. But how do markets and financial institutions respond when RTP is introduced as another digital payment mechanism? Can RTP co-exist with other traditional digital payments?

To answer these questions, we studied the global RTP implementation landscape in over 40 markets between 2018 and 2022. The key takeaway is that in markets with a mature credit card economy, the introduction of RTP had minimal impact on credit card volume.

Real-time payments are payment transactions between bank accounts. They are initiated, cleared and settled within seconds, at any time of the day or week, holidays, as well as weekends. RTP have several common characteristics, including:

- Real-time authorization and settlement

- Ubiquitous systems, accessible by all financial institutions regardless of size

- Available 365/24/7

- Open-loop environment where each payment is processed individually

- Data-rich messaging, ISO 20022, to support value-added products or use cases, like B2B payments

- Safety and security by requiring strong authentication prior to initiation

- Network-level monitoring and reporting

How four markets gave us answers

We focused our research on economies with mature card markets similar to the U.S. We call these “minimal impact markets,” and to compare each one consistently and reliably, four key factors were considered:

- Market: How developed is the card market, and what are its main characteristics? We considered the existing level of card penetration, the banked population and Point of Sale (“POS”) terminal penetration. In general, we expected that the more developed a card market is, the lower the impact of RTP on the payment mix.

- Consumer: Does RTP represent a compelling payment method in the eyes of the average consumer? How does it compare with competing solutions, and what financial incentives are offered to consumers?

- Merchant: Does RTP represent a viable alternative for merchants? Does RTP offer competitive merchant fees compared to cards, and is the approval and setup process quick and streamlined?

- Government: Have central institutions actively pushed the introduction of RTP in the country, through regulation or public policy?

In the “minimal impact market” scenario, we observed RTP usage in four markets, each with different solutions.

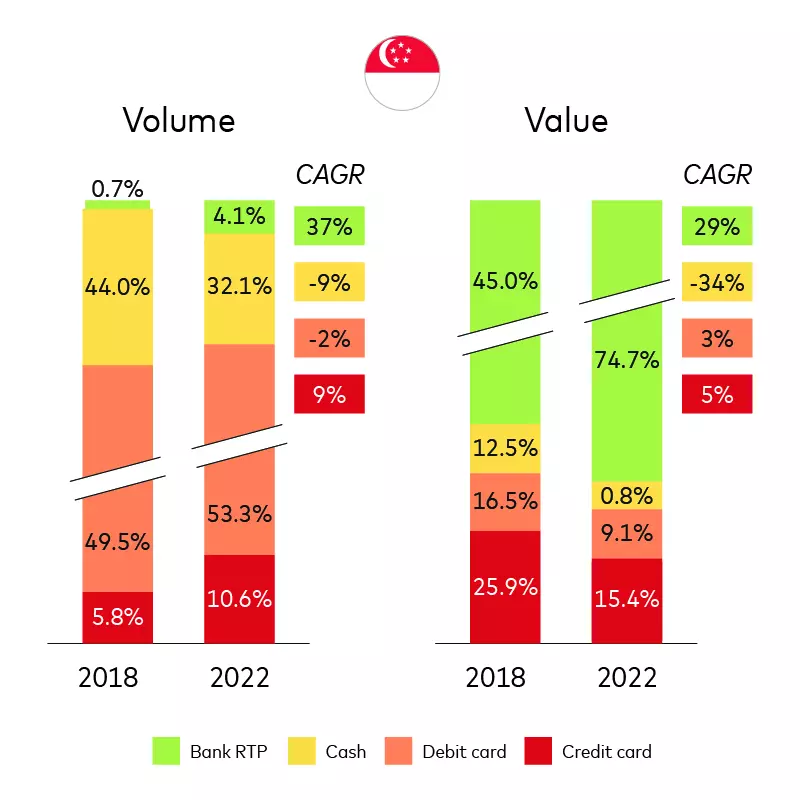

Singapore

In 2014, FAST (Fast And Secure Transactions) was the first RTP solution launched in Singapore. The system offers immediate bank transfers and debit requests (up to 10.000 S$) in real-time, 24/7 and online. In 2017, PayNow launched a proxy service that sits on top of FAST, providing the ability to pay businesses and consumers via a mobile number, NRIC or Virtual Proxy Addresses (FAST required bank and account number details).

RTP payments is the faster growing payment method in Singapore, while cash usage is declining at high rate. Cards are still the most used instrument in the country.

RTP payments is the faster growing payment method in Singapore, while cash usage is declining at high rate. Cards are still the most used instrument in the country.

UK

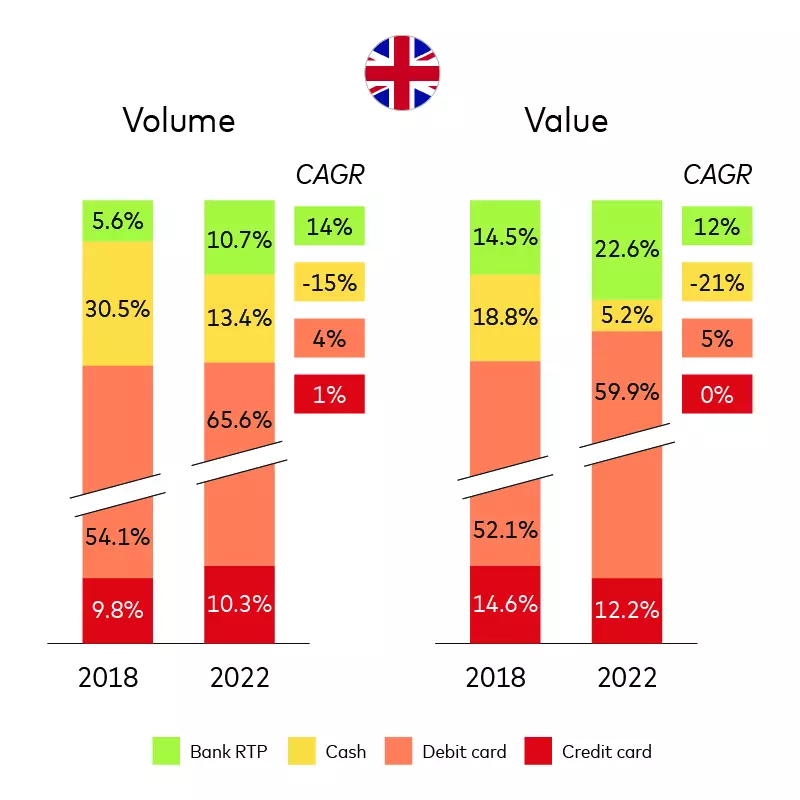

Faster Payment System, launched in 2008, was designed to speed up the process of sending money in the U.K. The Faster Payment System checks the payment instructions and forwards them to the supplier's receiving bank. The receiving bank then checks that the account number is valid and informs the Faster Payment System that it has accepted (or rejected) the payment.

RTP payments in the UK are still growing at a high pace 15 years after its launch, gaining its spot as the second most important payment instrument after debit cards. Cash usage has been declining significantly and credit cards usage has stalled.

Nordics

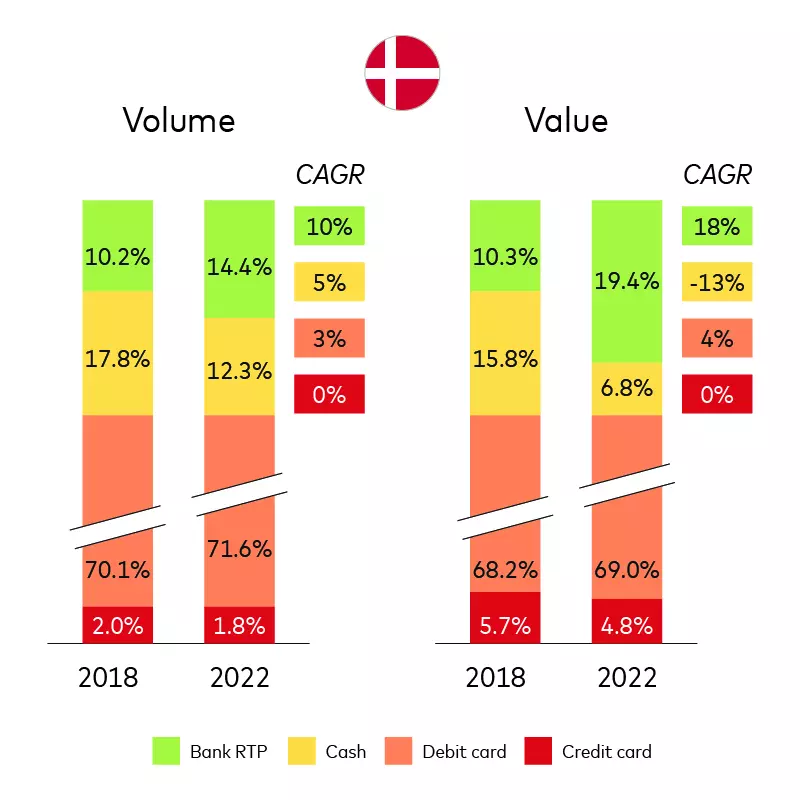

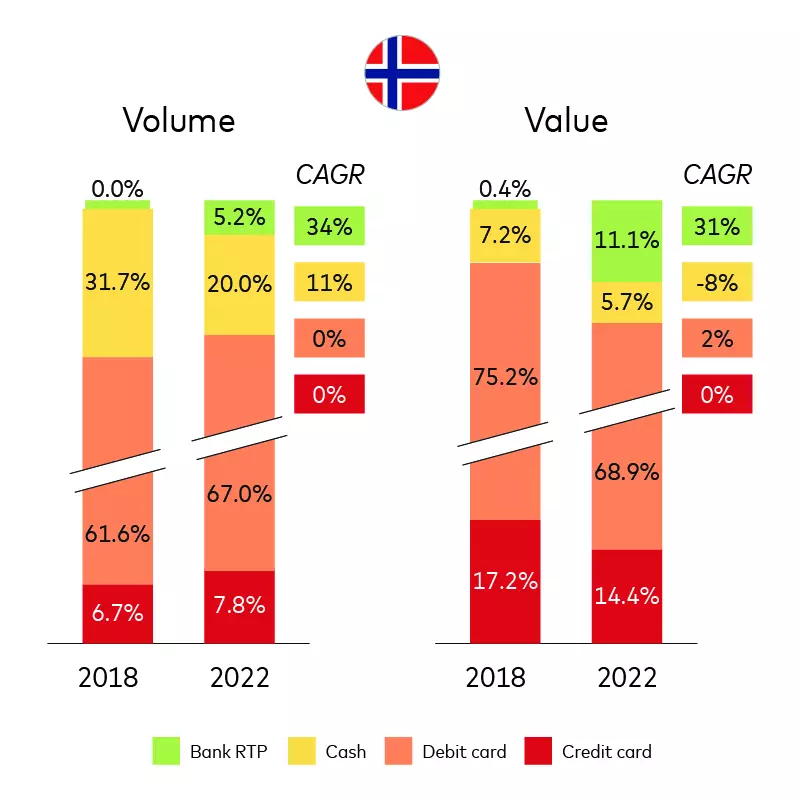

Denmark pioneered advancements in RTP with the 2014 launch of Straksclearing, the infrastructure powered by the Danish central bank, which enables RTP for banks that join the system. Due to its increasing popularity, the Norwegian mobile payments app, Vipps, joined the Straksclearing system in 2021, unifying payment solutions across Scandinavia.

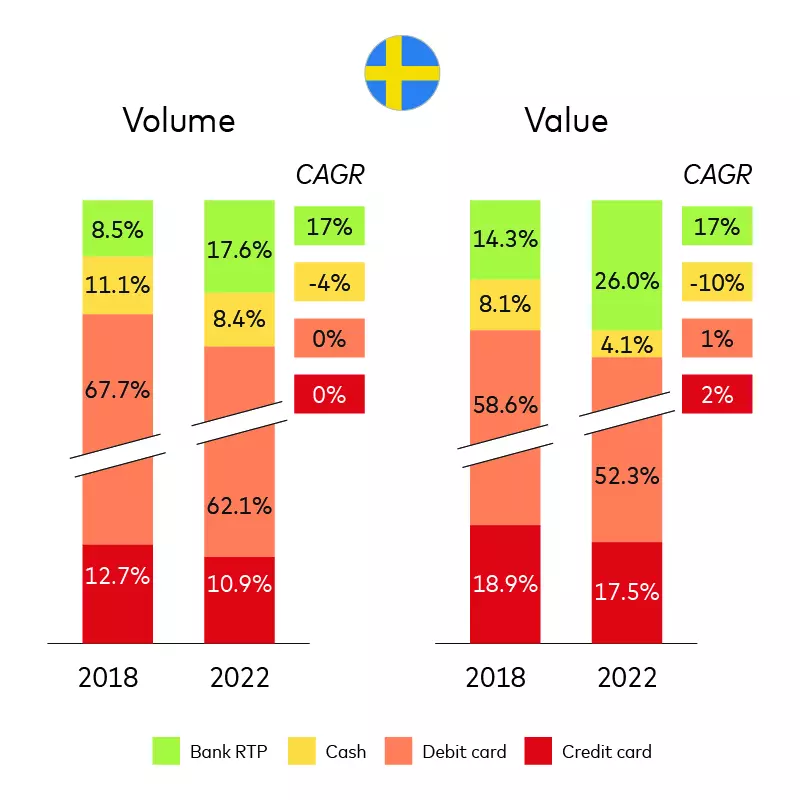

Sweden adopted a different RTP solution. The system is called BiR (Betalningar i Realtid) and is operated by Bankgirot, a private payment clearing system owned by Swedish banks. The end-user interface is the Swish app, which had 8 million users as of July 2022. In 2023, Swish payments will be settled through a new protocol called RIX-INST, which involves the Swedish central bank, Riksbank.

While RTP in the Nordics is already well established, the goal is to expand the collaboration among countries. For example, Denmark, Finland and Sweden agreed to launch P27, a new RTP infrastructure allowing real-time, cross-border payments in multiple currencies.

Denmark and Sweden are slightly more digital countries than Norway, where there's still a high volume of cash transactions. But all three economies are getting closer to becoming cashless, with growing usage of debit, credit and RTP.

Peru

With the modernization of the payment infrastructure starting in 2017, Peru’s Electronic Clearinghouse (CCE) became the designated player in connecting financial institutions and credit unions to offer electronic transfers and payments. It operates under the oversight of the Central Reserve Bank of Peru (BCRP) and processes various payment types, including wages and salaries, taxes and social security payments.

As part of the technology renewal project, the CCE worked with the Mastercard-Vocalink infrastructure solution, to revamp its systems for batch transfers using BPS (Bulk Payment System) and immediate transfers with the launch of IPS (Instant Payment System) to enable real-time transfers in May 2022. This brought capabilities that financial institutions and the overall ecosystem in Peru can use to establish an interoperable, real-time payments scheme that offers a differentiated user experience and achieves the country's development goals.

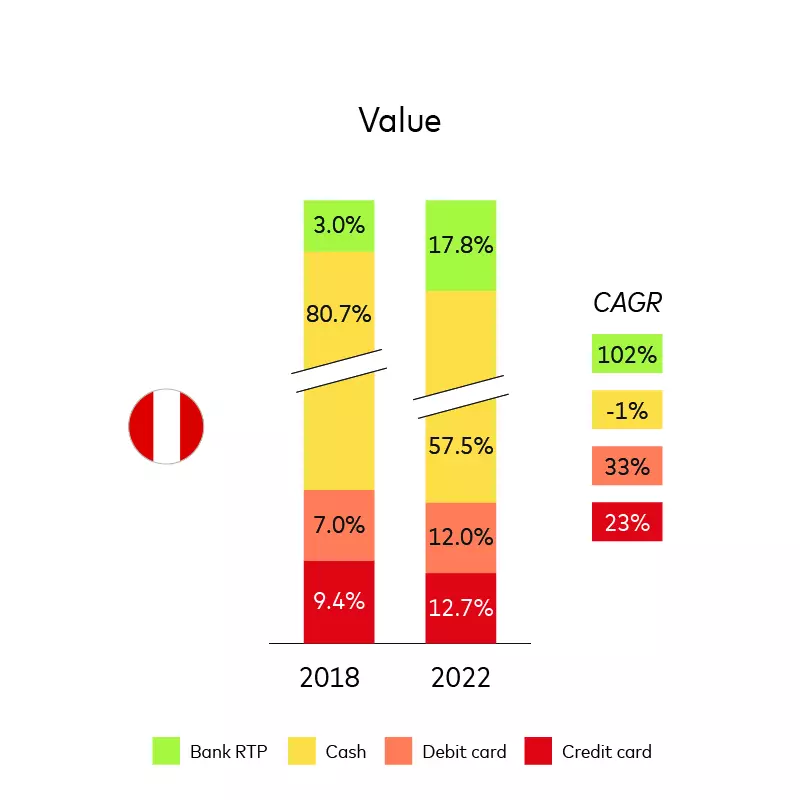

Peru still has high cash usage and low penetration of debit and credit cards, but RTP payments are growing quickly and likely soon to cannibalize cash.

RTP and cards are better together

RTP in these entrenched card markets had minimal impact on card volumes and values from 2018 to 2022. In every case, cards continue gaining a share in the payment mix, supporting cash displacements. Four key factors help us understand why RTP works well in these economies:

- Market: All of these markets had more than 50% credit and 80% debit card penetration when RTP was launched. In these markets, cards are the predominant payment system.

- Consumer: The RTP user experience can be more complex compared to cards. However, lower RTP usage fees makes it a popular payment option for “just in time” payments or payments where speed is important.

- Merchant: For merchants, the RTP fee structure is competitive compared to cards and sign-up bonuses are offered at launch. From a technical standpoint, RTP has a quick online application and potentially fewer physical POS machines.

- Government: Governments in these countries have supported the introduction of RTP payment systems, sometimes even enforcing mandatory bank participation, driving up the usage for certain RTP applications, including people to government authorities (P2G) payments and tax payments.

In markets with heavy card adoption, a large, banked population and high POS penetration, RTP will drive payments digitization, financial inclusion and growth opportunities. However, even when RTP is highly encouraged by central institutions and quickly adopted by merchants, there is no direct impact on traditional card usage. The only payment types shrinking for all these countries is cash and checks.

Conclusion

The main drivers to predict the market response to an RTP solution are the maturity of the existing cards market and the attractiveness of the solution in the eyes of customers.

In a country with high card penetration and usage, RTP adoption is slower and not at pace with card growth. But even in environments where RTP rapidly expands, the cards business is still thriving and not impacted by the alternative solution.

Cards and RTP can co-exist and grow their share in the total payments mix. Understanding the possible developments of card markets under different conditions is an important first step in understanding how different forms of payment work together.

To learn more about how Mastercard works with organizations to provide real-time payment solutions, reach out to your Mastercard representative or request a demo.